Managing money is one of the most important life skills, yet many people struggle with it. Two of the most popular budgeting methods used today are the 50/30/20 rule and zero-based budgeting. Both methods help you take control of your money, but they work very differently. In this article, we will compare 50/30/20 rule vs zero-based budgeting, explain how they work, and help you choose the method that fits your lifestyle, income, and financial goals.

Budgeting does not have to feel stressful or complicated. With the right plan, you can stop living paycheck to paycheck, save more money, reduce debt, and become more confident about your financial future. Let’s find out which budgeting method is the best match for you.

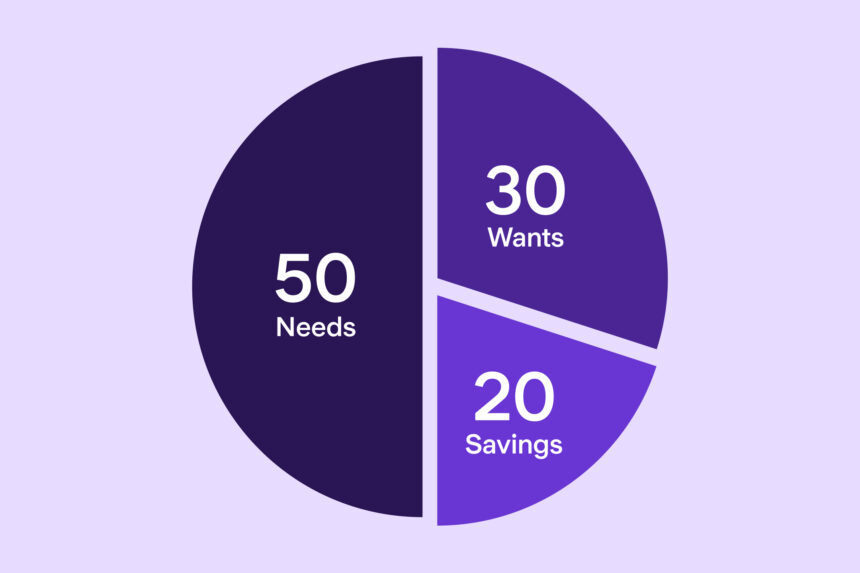

What Is the 50/30/20 Rule?

The 50/30/20 budgeting rule is a simple money management system that divides your monthly income into three main parts. It was popularized by U.S. Senator Elizabeth Warren in her book on personal finance, and today it is one of the most widely used budgeting systems across the world.

According to this rule:

- 50% of your income should go to needs

- 30% of your income should go to wants

- 20% of your income should go to savings and debt repayment

The biggest advantage of the 50/30/20 method is that it is easy. Even beginners can follow it without much effort. You do not need to track every single expense. You only need to make sure that your spending stays within these three main categories.

How the 50/30/20 Rule Works in Real Life

Suppose you earn ₹60,000 per month (or $3,000 if you’re reading from abroad). According to the rule:

- ₹30,000 (50%) goes to needs like rent, groceries, utilities, transportation, and basic bills.

- ₹18,000 (30%) goes to wants like dining out, entertainment, shopping, and hobbies.

- ₹12,000 (20%) goes to savings, investments, or extra loan payments.

This method gives you freedom and balance. You can enjoy your life while still saving for the future.

What Is Zero-Based Budgeting?

Zero-based budgeting, also known as ZBB, is a detailed budgeting method where every single rupee or dollar you earn is assigned a purpose. When you make your monthly budget, your income minus your expenses should equal zero. That does not mean you have zero money left. It simply means every part of your income has a job — whether it is for bills, savings, investments, shopping, or emergency funds.

This method was made famous by financial experts like Dave Ramsey and is commonly used in business budgeting too. Many people who want strict control over their spending prefer zero-based budgeting because it forces them to think deeply about their money.

How Zero-Based Budgeting Works in Real Life

If you earn ₹60,000 per month, you create a budget like this:

- Rent: ₹15,000

- Groceries: ₹6,000

- Transport: ₹3,000

- Electricity: ₹2,000

- Savings: ₹10,000

- Emergency Fund: ₹3,000

- Entertainment: ₹5,000

- Personal Expenses: ₹4,000

- Investments: ₹5,000

- Miscellaneous: ₹2,000

Everything must add up to ₹60,000. This means you are fully aware of where your money is going, and nothing is unplanned.

50/30/20 Rule vs Zero-Based Budgeting: Which One Works Better?

Both budgeting systems help you manage your money effectively. The question is: which one is better for you? The answer depends on your financial goals, lifestyle, discipline, and personality.

Below, we explore the key differences to help you make the right choice.

1. Simplicity vs Detail

The 50/30/20 rule is extremely simple. You only track your expenses in three categories. This is perfect for beginners, teenagers, or busy professionals.

Zero-based budgeting, however, requires more time because you must track every single rupee.

If you want ease → choose 50/30/20.

If you want full control → choose zero-based budgeting.

2. Flexibility vs Structure

The 50/30/20 method allows more flexibility. You do not need to justify small expenses as long as they fit the 30% “wants” category. Meanwhile, zero-based budgeting is strict because everything must be planned beforehand.

If you enjoy freedom → choose 50/30/20.

If you prefer discipline → choose zero-based budgeting.

3. Best for Beginners vs Best for Serious Planners

The 50/30/20 rule is perfect for someone who has never budgeted before. You can start using it immediately with minimal effort.

Zero-based budgeting is better for people who want to:

- Pay off debt quickly

- Save aggressively

- Track spending deeply

- Improve bad money habits

If you’re just starting → use 50/30/20.

If you want a tighter budget → use zero-based budgeting.

4. Works Better for Stable Income vs Variable Income

The 50/30/20 rule works best when your monthly income is stable.

Zero-based budgeting is excellent for freelancers, business owners, or gig workers because they can create a new plan each month based on actual income.

If your income is steady → choose 50/30/20.

If your income changes frequently → choose zero-based budgeting.

5. Which Method Helps Save More Money?

Zero-based budgeting typically helps people save more because it forces intentional planning. However, the 50/30/20 rule also ensures you save at least 20% every month, which is great for long-term financial growth.

If saving more is the goal → choose zero-based budgeting.

If a balanced lifestyle matters → choose 50/30/20.

Which Budgeting Method Should You Choose?

There is no single system that works for everyone. Your perfect budgeting method depends on:

- Your income level

- Your financial goals

- Your spending habits

- Your personality

The 50/30/20 rule works best when:

- You want simple budgeting

- You are new to money management

- You want a balanced life with spending freedom

Zero-based budgeting works best when:

- You want strict control

- You want to eliminate debt

- You want to save aggressively

- You want to plan every part of your finances

Some people even combine both methods. For example, you can follow the 50/30/20 rule, but create a detailed zero-based plan only for the “needs” section. This gives you both structure and freedom.

Why Budgeting Matters for Financial Success

Budgeting is not just about reducing expenses. It helps you:

- Stop impulse spending

- Build an emergency fund

- Save more money

- Reduce financial stress

- Reach long-term goals like buying a home or investing for retirement

If you want to explore more financial tips, guides, and smart money strategies, check out WhiteHat Finance . You’ll find easy-to-understand articles that help you become smarter with money.

Frequently Asked Questions (FAQs)

1. Is the 50/30/20 rule still effective in 2025?

Yes. The 50/30/20 rule continues to be effective because it is simple and helps people manage money even when prices change. You may adjust the percentages slightly based on your lifestyle.

2. Is zero-based budgeting hard to follow?

It requires more effort because you must track every expense. But once you make it a routine, it becomes easy and gives you full control over your finances.

3. Can I use both budgeting methods together?

Yes. Many people combine them. For example, use the 50/30/20 rule for overall structure but plan every rupee of the 50% “needs” category using zero-based budgeting.

4. Which method is better for saving money fast?

Zero-based budgeting is better for fast savings because it gives tight control over spending and helps you avoid unnecessary expenses.

5. Which budgeting method is better for beginners?

The 50/30/20 rule is better for beginners because it is easy, simple, and stress-free.

Final Thoughts & Call to Action

Choosing between the 50/30/20 rule vs zero-based budgeting depends on what works best for you. If you want something simple and flexible, go with the 50/30/20 rule. If you want strict control and faster financial growth, choose zero-based budgeting.

No matter which method you pick, the key is to stay consistent and review your budget monthly. A good budget is the first step toward financial freedom.